The crypto market eagerly awaits the upcoming FOMC next week for potential cues on Fed rate cut decisions, which could significantly impact the Bitcoin and altcoin prices. By Rupam Roy 9 hours ago

Highlights

- The crypto market eagerly awaits the FOMC next week for cues on Fed’s monetary policy stance.

- The market anticipates a 25 bps Fed rate cut next week, which is expected to boost the Bitcoin and altcoin prices.

- The traders are also expecting the upcoming US election to impact the crypto market performance.

The crypto market eagerly awaits the upcoming FOMC interest-rate decision by the US Federal Reserve this week. It is one of the highly anticipated events this week, which is expected to shape the sentiments in the digital assets space, potentially setting the path for Bitcoin and other altcoins. Although the market is anticipating a dovish stance by the central bank, any other move could trigger a selling pressure in the market.

Crypto Market Enters Crucial Week With FOMC In Focus

The crypto market enters a crucial week with a flurry of events scheduled that could shape the future of digital assets. Among these, the market participants are eagerly waiting for the upcoming FOMC for cues over the central bank’s stance on their monetary stimulus plans.

Notably, concerns mounted over the past few days over a potential pause in the US Fed’s rate cut plans, especially with the economic data weighing on traders’ sentiment. However, the latest US Job report appears to have shrugged off concerns, while cementing bets towards a 25 bps Fed rate cut next week.

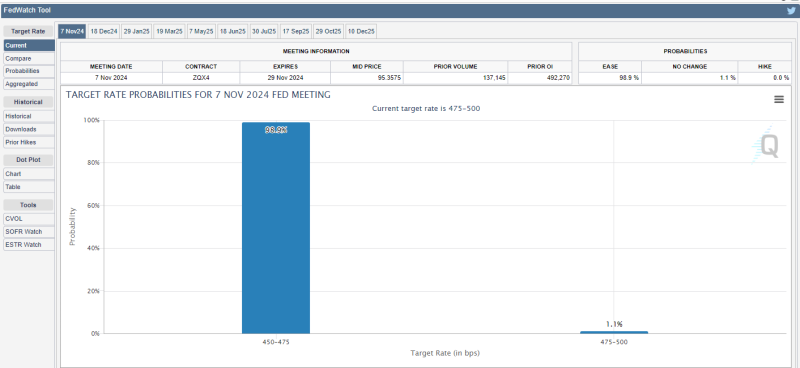

The latest Job data showed weaker job creation in the US in October, with the unemployment rate remaining unchanged from September. This has fueled hopes of two more rate cuts this year, one being in next week and the other in December. According to the CME FedWatch Tool, there is about a 99% chance of a 0.25% point cut in November.

Source: CME FedWatch Tool

This has also sparked investors’ hopes towards a potential rally for Bitcoin price and other top altcoins. Usually, the lower interest rates raise the risk-bet appetite of investors, potentially benefiting digital assets, stocks, gold, and other risker assets.

Will Bitcoin And Altcoins Rally?

The crypto market participants are anticipating the upcoming FOMC to trigger a rally in Bitcoin and altcoin prices. Besides, the US Presidential Election, scheduled for November 5, will also play a key role in shaping the future of the broader financial markets, let alone the digital assets space.

Notably, the market is anticipating a potential upward momentum for crypto, irrespective of Donald Trump or Kamala Harris’s victory. Although the market anticipates Donald Trump’s win to provide more boost to the crypto market, a recent Bitcoin price analysis suggests that Kamala Harris’s victory could also propel a market rally.

On the other hand, historically, Bitcoin tends to showcase a positive performance in the fourth quarter of the year. Having said that, the market anticipates a similar performance in 2024, while many expect the other altcoins to follow suit.

However, many in the crypto community also warned over potential volatility in the market due to the upcoming US election. Considering that, the investors should exercise due diligence while putting their bets into the assets.