The crypto market braces for the impact of US PCE inflation, FOMC minutes, Q3 GDP data, and crypto expiry, amid the ongoing rally in the market. By Rupam Roy 9 hours ago

Highlights

- US PCE inflation, FOMC minutes to impact crypto market.

- Crypto expiry worth $10 billion to spark market volatility.

- The crucial events are expected to impact the market sentiment this week.

The crypto market enters a crucial week, with a flurry of key events like the US PCE inflation, FOMC Minutes, and Q3 GDP (first revision) data, among others, scheduled. In addition, the crypto market expiry has also fueled concerns among the market participants. For context, the investors are awaiting the impact of these events, as the broader market noted a massive rally in recent days.

US PCE Inflation & FOMC Minutes In Focus

The crypto market awaits a flurry of key economic events this week, including US PCE, FOMC, and others, with speculations soaring over the potential impact on asset prices. Notably, the week will start with Consumer confidence data and US FOMC for November scheduled on Tuesday, November 26. This would provide further cues on the Fed’s potential stance with their monetary policy plans, which usually affect the investors’ sentiment.

In addition, the minutes will also be closely watched, as recent reports showed that the US Federal Reserve said that it won’t be focusing on the 2% inflation target ahead. Besides, with Donald Trump’s election victory and Elon Musk’s focus on cutting Federal spending, investors will keep close track of the central bank’s minutes this week.

Following that, the market participants will await the US GDP figures for the third quarter. The first revision of the economic figure is scheduled for Wednesday, November 27, which will provide cues on the US economic health. This is also likely to impact the sentiment of the broader financial sector, let alone the crypto market.

Meanwhile, investors will be closely watching the inflation figures, especially after recent data indicates prices are soaring. The US PCE inflation, set for Wednesday, is expected to come in at 0.2% in October, unchanged from the previous month’s figure. On the other hand, the YoY PCE figure is expected to accelerate at 2.3%, as compared to 2.1% noted in the prior month.

In addition, the Core PCE inflation figures, which exclude the energy and food prices, are expected to show a 2.8% surge, up from the 2.7% noted in September. However, the monthly figure is expected to remain unchanged at 0.3%.

Will Crypto Expiry Impact The Ongoing Rally?

Bitcoin and other top altcoins have noted robust rallies recently, with optimism hovering in the market after Donald Trump’s election win. However, some market experts anticipate the upcoming crypto expiry to impact the market sentiment.

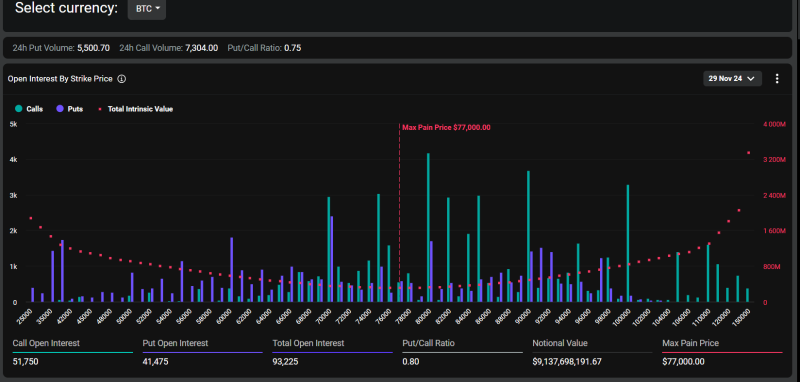

According to Deribit data, $9.13 billion in Bitcoin options is set to expire on November 29, with a put/call ratio of 0.80. The max pain price is $77,000. On the other hand, $1.24 billion Ethereum is also set to expire on the same date, with a put/call ratio of 0.77 and a max pain price of $2,800.

Source: Deribit

This crypto expiry, worth more than $10 billion, is likely to spark volatility in the market, impacting investors’ sentiments. In addition, many top experts including Peter Brandt hint towards a potential Bitcoin selloff ahead, while remaining optimistic about the crypto’s long-term trajectory.

Having said that, the market will keep close track of the US PCE inflation figures, FOMC minutes, and other macroeconomic events. In addition, the crypto expiry is also expected to impact the traders’ sentiment, especially amid the ongoing rally in the market.