Contents

Explore if Ethereum price will hit $4,000 while Bitcoin consolidates above $90,000, failing to hit $100,000. Will ETH bulls succeed? By Akash Girimath 2 hours ago | Updated 14 minutes ago

Highlights

- Ethereum price today is showing signs of continuing its uptrend.

- A successful spike in bullish momentum could send ETH to $4,000.

- A breakdown of $3,350 support level could trigger a 14% crash to $2,886.

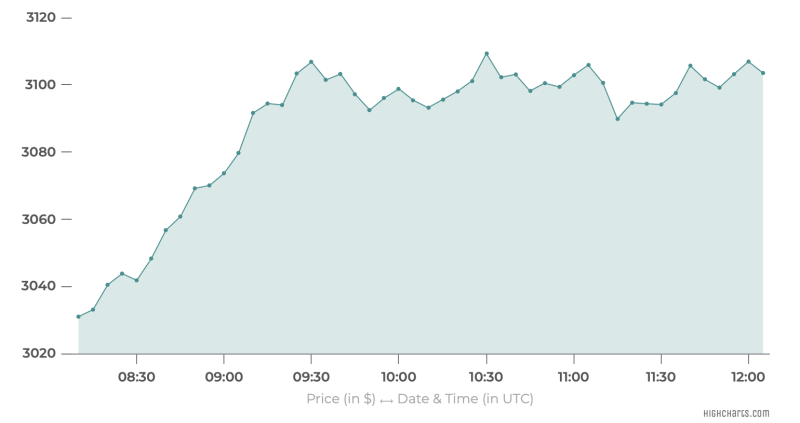

Despite the recent Bitcoin crash, Ethereum (ETH) price trades today at $3,559.1 as of 5 PM. Surprisingly, ETH performance during the recent crash is much better than most altcoins. Regardless, Ethereum prices today hit a daily high of $3,682.3 after -0.34% move on November 28.

Ethereum Price Today: Why is ETH Up?

Ethereum price performance relative to its peers shows strength. While altcoins gave gains back to the market due to Bitcoin’s sudden downtrend, Ethereum price climbs higher. This strength shows a paradigm shift that hints at an end of Ether’s lackluster performance. If BTC consolidates or climbs higher, the ETH price could extend its gains. But a drop in BTC toward $90k could delay this uptrend. could drop lower or climb higher.

Ethereum Price Chart Today

*Ethereum price updated as of 5 PM.

Ethereum’s innovative smart contract technology has made it a standout altcoin since its inception in 2015. Continuous major network upgrades ensure Ethereum stays ahead in smart contract innovation. The latest upgrade, Cancun, launched on March 13, 2024.

Ethereum Price Outlook

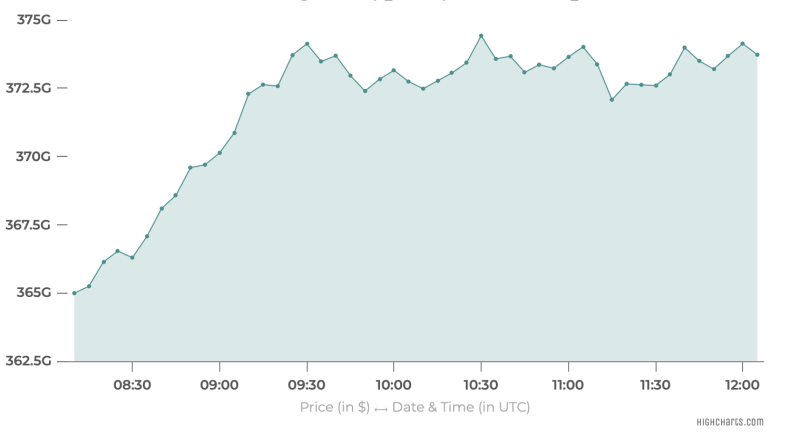

ETH’s year-to-date (YTD) performance continues to increase and currently sits at 33%. This recent slump in Bitcoin price has affected the YTD gains, which have dropped from 50% since November 11. As of November 28, 2024, if you invested $10,000 in ETH on January 1, 2024, your portfolio, after 317 days, would be up roughly $3,317. Ethereum’s market capitalization stands at $428.8 billion.

Ethereum: The Second-Largest Crypto By Market Cap

Ethereum ranks second in market capitalization, valued at $428.8 billion, after Bitcoin’s $1.73 trillion. Together, BTC & ETH’s market capitalization constitutes 83% of the total crypto market cap.

Since its all-time high of $571 billion in November 2021, Ethereum’s value decreased by half in October, but has spiked recently due to Bitcoin’s new ATH. Still, Ethereum maintains a strong lead over other popular cryptocurrencies:

- Solana (SOL): $98.8 billion

- Ripple (XRP): $89.8 billion

- BNB (BNB): $91.0 billion

Despite this recent downtick and recovery, the 24-hour trading volume of Ethereum is $42.7 billion.

Ethereum’s Crypto Trading Volume Soars

The 24-hour trading volume of Ethereum is $42.7 billion. Binance is the largest contributor to this trading volume – about 11% is contributed by spot trading and nearly 40% from futures trading. Exchanges like OKX, Bitget, and ByBit follow Binance.

Ethereum Upgrades to Proof-of-Stake Technology

The London hard fork is a significant Ethereum blockchain upgrade. It changed the network from Proof-of-Work (PoW) to Proof-of-Stake (PoS). Ethereum co-founder Vitalik Buterin recently shared his thoughts on X (formerly Twitter). He explained how Proof-of-Stake (PoS) is more decentralized than Proof-of-Work (PoW).

Notable Ethereum Blockchain Upgrades in 5 Years

Here are some key upgrades in the past five years that shaped Ethereum as the second-largest crypto by market capitalization.

2024:

- Cancun-Deneb (“Dencun”): This upgrade aimed to improve Ethereum’s scalability, security, and usability, setting the stage for further enhancements.

2023:

- Shanghai-Capella (“Shapella”): Enabled the withdrawal of staked Ether (ETH), marking a significant milestone in Ethereum’s transition to a Proof-of-Stake (PoS) consensus algorithm.

2022:

- Paris (The Merge): Successfully transitioned Ethereum from a Proof-of-Work (PoW) to a Proof-of-Stake (PoS) consensus algorithm, reducing energy consumption and increasing security.

- Bellatrix: Prepared the Ethereum network for The Merge by introducing the necessary PoS consensus logic.

- Gray Glacier: Delayed the “difficulty bomb” that would have slowed down the network, ensuring a smooth transition to PoS.

2021:

- Arrow Glacier: Delayed the “difficulty bomb” again, providing more time for the transition to PoS.

- Altair: Introduced several improvements to the Beacon Chain, including better validator incentives and enhanced security.

- London: Implemented the highly anticipated EIP-1559, which reformed the transaction fee market, making it more efficient and user-friendly.

- Berlin: Introduced several protocol upgrades, including improved gas efficiency and enhanced security features.

2020:

- Beacon Chain genesis: Launched the Beacon Chain, marking the beginning of Ethereum’s transition to PoS.

- Staking deposit contract deployed: Enabled users to deposit ETH and participate in the PoS consensus algorithm.

-

Muir Glacier: Delayed the “difficulty bomb” to ensure a smooth transition to PoS.

How ETH Gas Affects Ethereum Price

The blockchain upgrades Ethereum receives aim to solve the trilemma of blockchain, i.e., balancing decentralization, security, and scalability. The switch to Proof-of-Stake (PoS) enhanced these aspects. Ethereum’s transaction fees (gas fees) plummeted post-upgrade, drawing more investors. Gas fees are like taxes, measured in Gwei, required for secure transactions.

As of November 28, the gas fee for a transaction on the ETH network as of 5 PM is 14 Gwei.

When Ethereum’s on-chain value grows, presenting opportunities, investors flock, driving gas fees up. This typically occurs during market upswings, peaking at all-time highs.