Bitcoin price hits new all-time high of $80,000 amid ‘Extreme Greed’, with 100% addresses in profit, signaling potential for correction. By Kelvin Munene Murithi 6 hours ago

Highlights

- Bitcoin hits new $80K ATH, pushing all BTC wallets into profit.

- BTC open interest up 4.16%, indicating robust market engagement.

- Bitcoin fear index at 78 signals potential for upcoming price correction.

Bitcoin price has reached a new all-time high, hitting $80,000 as of November 10, marking a milestone for the cryptocurrency.

This upward movement has pushed Bitcoin into what many analysts describe as the “price discovery” phase, where BTC’s future price trajectory is largely uncharted. However, market experts are divided on whether this rally will continue or if Bitcoin is primed for a correction in the near term.

Bitcoin Price Reaches New ATH At $80k

Bitcoin price climb to $80,000 has created an atmosphere of both excitement and caution within the cryptocurrency community. With 100% of Bitcoin wallet addresses now in profit, according to data shared by Ki Young Ju, CEO of CryptoQuant, many see this as a pivotal moment in Bitcoin’s price journey.

“We often see a correction when the price reaches these levels,” Ju commented, hinting that major investors might start taking profits soon. However, should the bullish rally continue, BTC price may continue its rally towards $100k, according to a Bitcoin price prediction.

The sharp rise in Bitcoin’s value has also triggered the “Extreme Greed” level on the Bitcoin Fear and Greed Index, which now stands at 78. Historically, this level of market sentiment often precedes price pullbacks as overbought conditions become more likely. Analysts warn that the intense bullish sentiment may soon invite selling pressure, especially if investors look to secure profits after significant gains.

Open Interest Signal Strong Market Activity

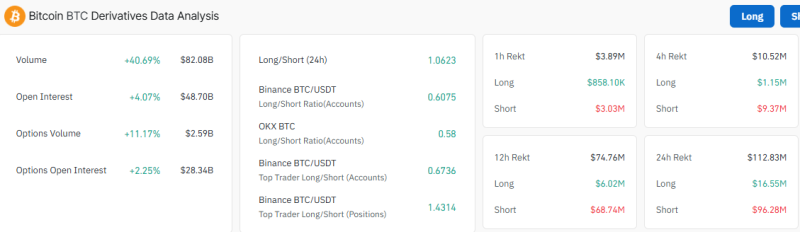

Trading volume and open interest in Bitcoin derivatives have both surged alongside the recent price increase. Data indicates a 33.31% rise in trading volume, now totaling $78.12 billion, which suggests heightened interest and activity. Open interest, the measure of total outstanding derivatives contracts, has also increased by 4.16% to $48.78 billion.

This surge in trading volume, coupled with increasing open interest, often signals that new money is entering the market.

BTC Derivatives Data (Coinglass)

Many traders view this as supportive of the current uptrend, as it suggests a strong flow of capital backing Bitcoin’s price rise. However, some analysts warn that the combination of high volume and open interest can also precede volatility, as larger players may capitalize on market momentum to make strategic moves.

Will BTC Price Continue To Rally?

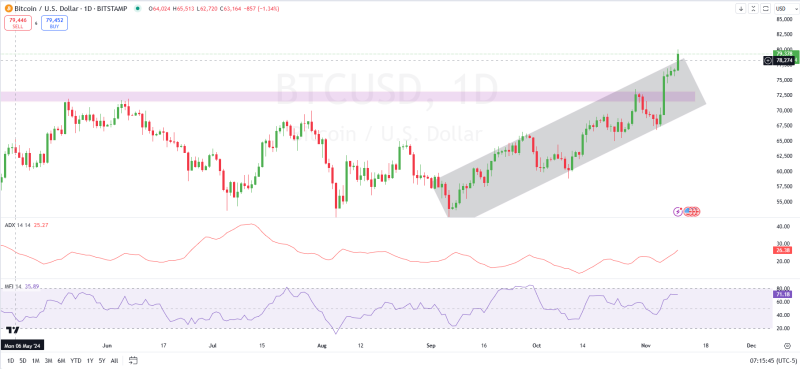

As BTC price breaches the $80,000 mark, technical analysts are keeping an eye on several key price levels. Immediate support is expected around the $75,000 to $76,000 range, which served as a recent resistance zone before Bitcoin’s breakout. If Bitcoin retraces, this level could act as a foundation for a potential bounce. Additional support may be found around the $70,000 to $72,000 area, where BTC consolidated for some time in prior trading sessions.

On the upside, the $80,500 level represents the first major resistance. Should Bitcoin break above this threshold, further resistance could emerge between $82,000 and $85,000. These levels align with historical highs and psychological milestones, where traders might again encounter selling pressure.

BTC/USD 1-day price chart (source: Tradingview)

Market indicators are showing signs that Bitcoin may be reaching an overbought state. The Average Directional Index (ADX) stands at 33.14, indicating a strong upward trend. Typically, an ADX reading above 25 signifies a healthy trend, and the current level suggests robust momentum in Bitcoin’s price movement.

However, the Money Flow Index (MFI) is near the overbought range, currently sitting at 71.03. An MFI above 80 generally indicates overbought conditions, which can precede short-term corrections or consolidations. As a result, some analysts are warning that Bitcoin may experience a pullback or a period of sideways movement if buying momentum slows.