Contents

Bitcoin falls 5% amid a 20% crypto market drop, influenced by macroeconomic data and cautious Federal Reserve policies. By Kelvin Munene Murithi June 15, 2024

Highlights

- Crypto market dips 20%; Bitcoin down 5% amid hawkish Fed outlook.

- CPI and Core CPI below expectations, hint at possible rate cuts.

- Treasury yields fall, yet dollar strength continues to pressure crypto.

- Gold climbs as cryptocurrencies struggle, highlighting investor caution.

The past week has witnessed significant downturns in the cryptocurrency market, with overall valuations sliding by 20% and Bitcoin by 5%.

This shift occurred amid macroeconomic data and global financial indicators contributing to the bearish sentiment.

Crypto Market Reaction to Macroeconomic Indicators

Crypto-analyst on Michael van de Poppe has explained the situation that is happening in the market and said that, despite the 20% drop in the total market capitalization, things in the market are not as bad as they seem. As pointed out by van de Poppe, this correction could be forming a ‘higher low,’ which means that the overall bullish trend is still intact.

A “higher low” is a bullish signal that indicates that the market could be regaining its mojo even after a retracement. This pattern can signal that investors are still optimistic about the future, buying into the market at these lower prices in anticipation of future gains.

Best Crypto Exchanges and Apps September 2024 Must Read Top Meme Coins to Buy Now: What You Need to Know Must Read Top 10 Web3 Games To Explore In 2024; Here List Must Read

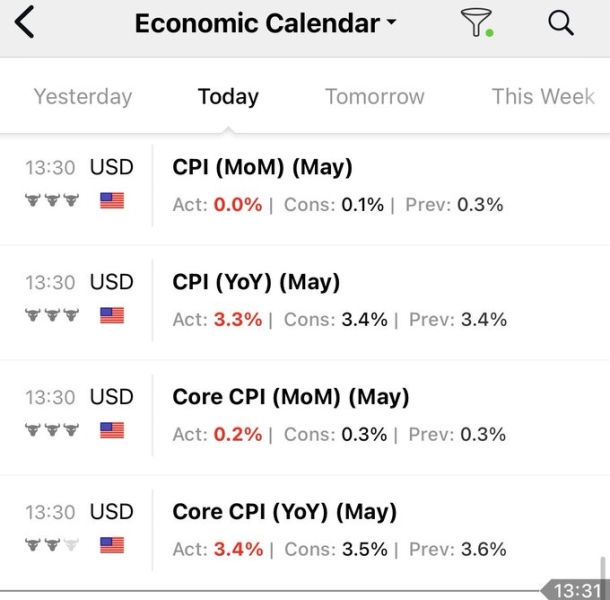

Recent data releases which have provided a rather mixed picture of the economic environment have been cited as the reason for this market trend. The Consumer Price Index (CPI), a key indicator used by the Federal Reserve in policy-making, rose by 3.3%, close to the expected 3.4%.

Likewise, the Core CPI, which strips out food and energy, was at 3.4%, slightly lower than the projected 3.5%. These figures indicate a slowing down of the inflation rates, which is generally good for risk-on assets such as cryptocurrencies, as they can lead to a reduction in interest rates.

In addition, the Producer Price Index (PPI) also reflected this trend with the overall figure standing at 2.2% against the expected 2.5%. The core PPI year over year was at 2.3%, lower than the expected 2.4%. Monthly figures also contracted, which is something that should normally bolster market confidence and the crypto market did not follow suit.

Federal Reserve Policies

The Federal Reserve‘s stance is a pivotal factor in the ongoing market dynamics. Federal Reserve Chair Jerome Powell delivered a surprisingly hawkish speech despite the softer inflation data.

Powell’s utterances and the change in the projected rate cuts for 2024 indicate that the FED is not likely to be as aggressive as the market anticipates in easing the monetary policy. This has led to a paradox where, due to lower inflation figures that should theoretically allow for rate cuts, the Fed’s cautious approach may negatively impact the market.

Also, Treasury bond yields have been quite volatile; the yield on two-year bonds fell considerably, touching a two-month low of 4694%. Although these are generally bullish indications for risk-on assets such as Bitcoin, the strong USD, which was boosted by recent rate cuts from the ECB, has put pressure on cryptocurrencies.

Gold Rises as Bitcoin Struggles

In contrast to cryptocurrencies, gold has experienced upward momentum, further highlighting the divergence in asset behavior amid similar economic conditions. The resilience of gold, often viewed as a safe-haven asset, may be drawing investors away from cryptocurrencies, which are still perceived as more speculative investments.

Meanwhile, Bitcoin’s (BTC) price has been on a bearish rally in the last week, with a 5% dip from an intra-week high of $70,059 to a weekly low of $65,267. At press time. BTC was trading at $66,320, a 1.29% drop from the 24-hour high.

Source: CoinMarketCap

Major cryptocurrencies have also been in a dip. The XRP price, for instance, has experienced a 2% decline in the last 7 days. However, XRP corrected this by allowing bulls to seize market control and, hence, a 1.94% rally to trade at $0.4846 at the time of writing.

The lack of momentum in the crypto markets can also be linked to regulatory uncertainties, such as the pending decision on the Ethereum ETF. This has left investors cautious, contributing to the bearish pressure.

However, bullish momentum has reignited in the ETH market with the updated timeline for a Spot Ethereum ETF by July 2nd. At press time, Ethereum (ETH) price was exchanging hands at $66,269, a 2.47% surge from the 24-hour low of $3,364.

Read Also: XRP Price Risks Falling To $0.42 As SEC and Lawyers Challenges Ripple On Penalties & Injunction